Last

week, we looked at the details of the scam in UTI's US-64 scheme and

also the reserves of different UTI schemes. This week, let us go through

the response from the public, the UTI notice on US-64 scheme, the

reform measures needed to revamp the functioning of UTI, enquiries

initiated to probe the scam and the way forward.

Last

week, we looked at the details of the scam in UTI's US-64 scheme and

also the reserves of different UTI schemes. This week, let us go through

the response from the public, the UTI notice on US-64 scheme, the

reform measures needed to revamp the functioning of UTI, enquiries

initiated to probe the scam and the way forward.

Public Confidence

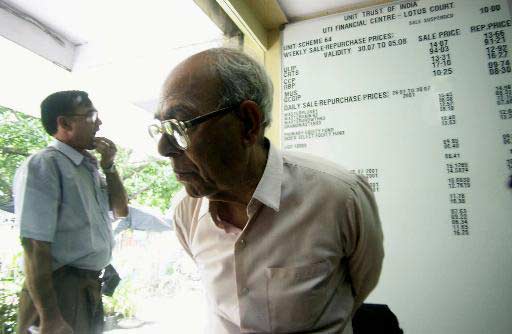

On 1st August 2001, UTI announced a limited repurchase window for

small investors of UTI's US-64 Scheme. Special liquidity package for

up to 3000 units of small investors for repurchase of US 64 unit holders

was released listing repurchase price from August 2001 to May 2003.

This started with 3,865 applicants redeeming their units at a face

value of Rs 10. This involved Rs 56.39 lakh units of the scheme, which

has resulted in cash outflow of Rs. 5.64 crores. This has to be contrasted

against the cash outflow of Rs 4000 crores due to the redemption of

units by big corporate houses at a value of Rs 14.55 per unit in April

and June. This belied wide spread rumours that UTI is in crisis and

investors would resort to panic selling. These redemption requests

were quiet in line with the usual redemption during initial few days

of any month. The new UTI chairman Mr Damodaran said that in last

August there were 2,306 applicants redeeming 44.65 lakh units. The

general view is that public need not get panicky. If the investors

wait till July next year, they can expect capital appreciation and

tax-free dividend on US-64. The advice of economic experts and analysts

is to stay with US-64 scheme for next two years.

Press Notice

from UTI

UTI issued a press notice on 2nd August 2001 on its US-64 Scheme.

The notice says that 2000-2001 is one of the most difficult year for

Indian and global economy. The markets registered a vertical fall.

In India, interest rates of banks have fallen and that of the small

saving schemes have dropped by 2.5% over the last 18 months. The press

note also mentions that the temporary suspension of sale and repurchase

of US-64 up to 6 months is aimed at smoothing the transition from

administered pricing into NAV-based pricing in line with the recommendation

by experts/committees. The chairman of UTI, Mr Damodaran expects the

government of India to find out a suitable mechanism to assist UTI

in case the net asset value of US-64 goes below Rs 10. The Trust has

decided to convert the scheme from administered scheme to NAV-based

from 1st January 2002.

The Trust is also restructuring the US-64 Scheme to make it a well-diversified

and balanced fund. Providing an assured repurchase price up to 3000

units for a period of nearly two years safeguards the interest of

small investors. The market is expected to revive well before May

2003. The press note also says that there will be no dilution of NAV

as a result of providing assured exit price to small investors. Any

deficit between NAV and applicable repurchase price will be met and

funded through external resources such as Development Reserve Fund

(DRF).

UTI press notice also claims that it turned the negative reserves

arising as on 30th June 1998 into positive reserves within a year's

time. There was also a substantial addition to reserves after making

two annual tax-free income distribution higher than that offered by

other comparable investment instruments.

As far as US-64 Scheme goes dividend of 10% (on face value) is consistent

and reasonable for the last 37 years. The rate of dividend is market-related

and always in consonance with the prevailing interest rate scenario.

According to the Press release from UTI, due to the increasing monthly

repurchase price and the expected revival of economy and markets,

in the long run, the small investors would also gain by keeping their

faith in US-64. ....more